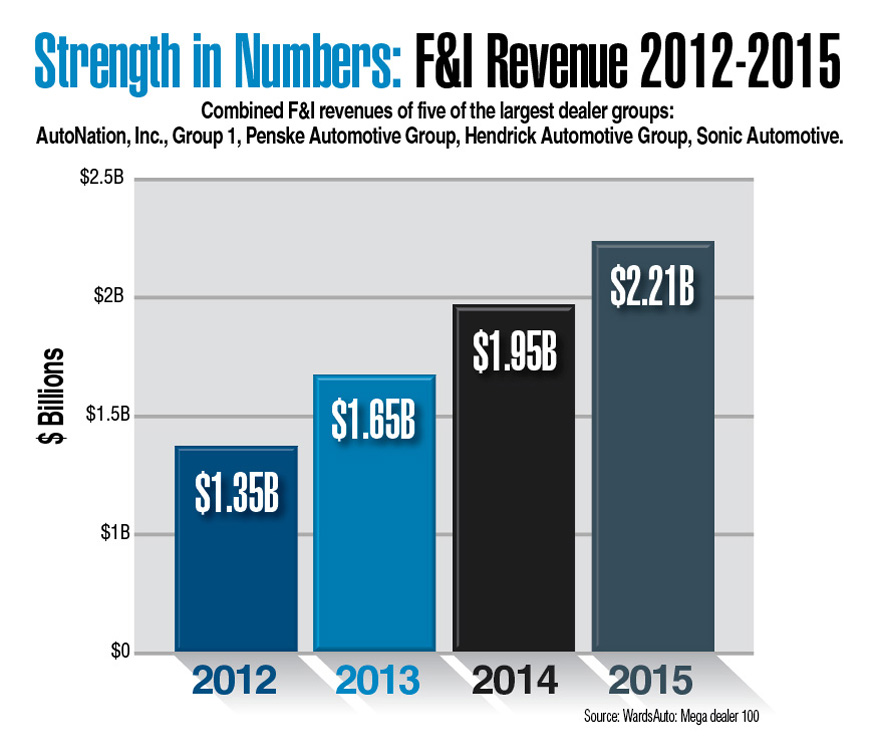

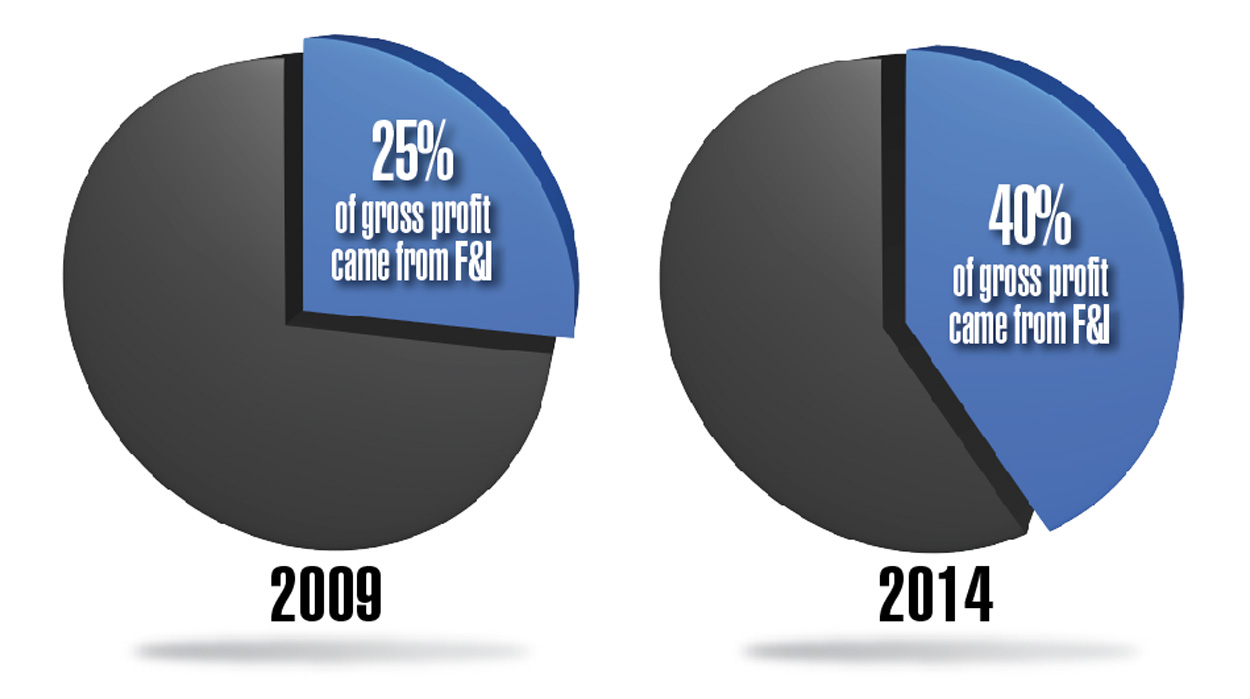

F&I products are becoming an increasingly important part of the revenue stream for dealerships. It’s a fiercely competitive market, and with companies like Kelly Blue Book and TruCar telling consumers the rock-bottom price they should negotiate for, margins on vehicles are being squeezed more than ever. At the same time, compliance issues make it increasingly difficult to mark up interest rates, further limiting profit margins for many dealerships. For the big dealer groups as well as the smaller operations, F&I product sales have become the best place to augment those numbers.

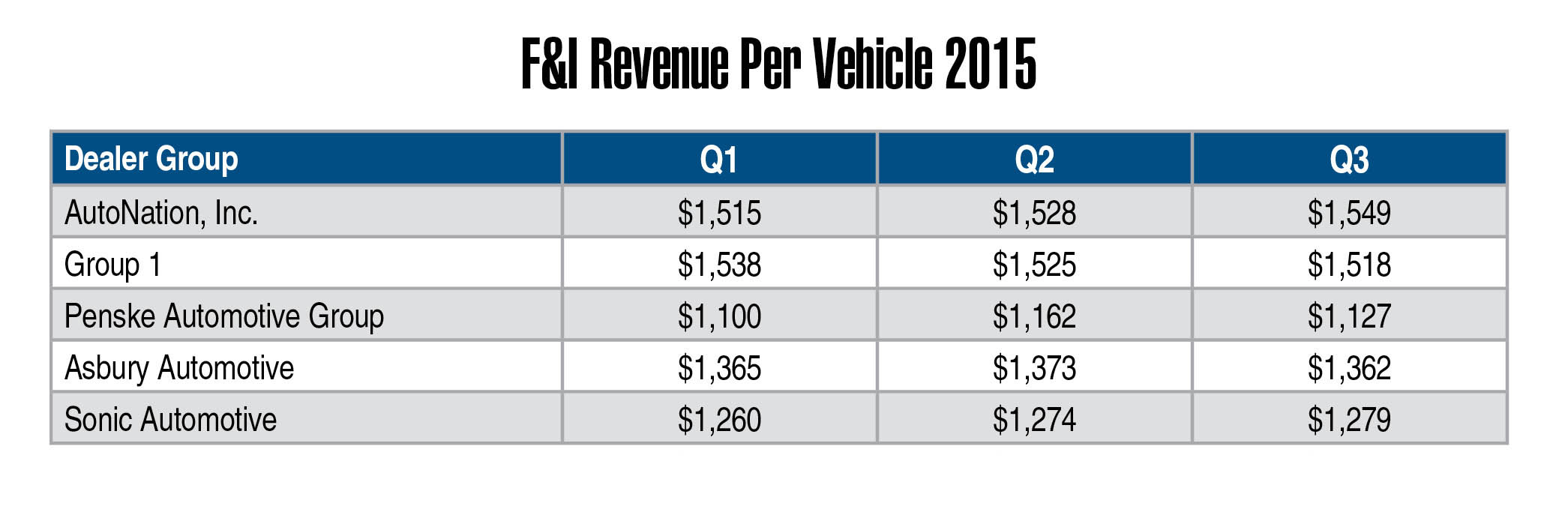

In a recent article, Automotive News noted that many of the large dealer groups across the country are reporting pretty solid third quarter numbers, with F&I revenue specifically showing gains. AutoNation in particular saw the year-over-year numbers for F&I revenue grow by more than 10{137f86425451f0eed4391b215cab1f0aedcc26ced4aeb45d9a5267c3194b8614}. To put it in perspective, the per-vehicle numbers for the group are up by nearly $150, which is a significant amount when you apply it across the more than 87,000 vehicles they sold in the third quarter alone. That is a pretty hefty boost to the bottom line.

While AutoNation saw the biggest increases, the trend of increasing F&I revenue per vehicle was consistent across all of the big groups who have reported their Q3 numbers so far. The increases are part of a trend that has been consistent over the past year, with F&I contributing to the bottom line more and more each quarter. It’s reasonable to assume that many dealerships are seeing similar increases.

Whether it’s massive F&I revenue gains in the double-digit percentages or more modest 1-2{137f86425451f0eed4391b215cab1f0aedcc26ced4aeb45d9a5267c3194b8614} increases, it’s clear that ancillary products are becoming more crucial to every vehicle sale. This underscores why it’s so important to clearly communicate the value of F&I products to consumers, as early in the process as possible. When consumers understand how these products protect their investment, dealers can regain some of the profits they’ve lost in other areas, and everyone wins.

We went back and pulled the numbers, and here is how the top five public automotive dealer groups have done with F&I sales per vehicle this year:

Original Source: http://roadvantage.com/2017/10/03/going-strong/